Angel investment refers to participation in a private placement of equity funding, usually from several qualified individual investors. It is typically used to supplement initial formation capital prior to seeking venture capital or public offering financing.

West Olympic Investments was formed to address the growing need for angel funding. As a qualified investor, we provide individual investments up to $1 million and as small as $25,000. In addition, West Olympic also makes business consulting services available to our investment companies, through optional board participation or special projects.

Key Benefits

- Provides small, targeted capital infusions.

- Allows a more rapid closing to fulfill immediate opportunities.

- Minimizes the equity dilution typically required by larger venture participation.

West Olympic and our parent corporation specialize in high technology and consumer investments, including the following:

High Technology / Biotechnology:

Biotech

polymers: Nexgenia develops and manufactures proprietary

stimuli-responsive polymers and polymer-containing magnetic

nanoparticles. Nexgenia’s stimuli-responsive polymer-based

nanotechnology represents the next generation in diagnostic and cell

separation reagents. We participated in the Series A equity

financing.

http://www.nexgeniacorp.com/

Biotech

polymers: Nexgenia develops and manufactures proprietary

stimuli-responsive polymers and polymer-containing magnetic

nanoparticles. Nexgenia’s stimuli-responsive polymer-based

nanotechnology represents the next generation in diagnostic and cell

separation reagents. We participated in the Series A equity

financing.

http://www.nexgeniacorp.com/

Marketing / social media management: We participated in

the Series A Preferred financing of Banyan Branch, a full-service

social media agency based in Seattle. Banyan Branch was

subsequently acquired by Deloitte Digital and operates as an

integrated digital agency providing interactive media strategy,

analytics, and complete program execution services.

www.deloittedigital.com

Marketing / social media management: We participated in

the Series A Preferred financing of Banyan Branch, a full-service

social media agency based in Seattle. Banyan Branch was

subsequently acquired by Deloitte Digital and operates as an

integrated digital agency providing interactive media strategy,

analytics, and complete program execution services.

www.deloittedigital.com

![]() Internet

Advertising Technology: We invested in this internet promotion

platform that increases marketing revenue lift over 45%.

Behavioral profiling software distills the topics, products,

interests and activities that internet visitors care about for

targeted ad display. In 2009 Others Online was acquired by

Rubicon Project, the

third largest online advertising company in the world.

www.othersonline.com

Internet

Advertising Technology: We invested in this internet promotion

platform that increases marketing revenue lift over 45%.

Behavioral profiling software distills the topics, products,

interests and activities that internet visitors care about for

targeted ad display. In 2009 Others Online was acquired by

Rubicon Project, the

third largest online advertising company in the world.

www.othersonline.com

![]() Online

Advertising/Navigation: We participated in the Series D

Preferred financing of Linkstorm, which offers ad enhancement

technology and a new way to navigate the web. Linkstorm allows

users to preview multiple relevant destinations within a single menu

by hovering over a link, image, ad or any other anchor to "unfurl"

the menu and make ads two to five times more effective.

www.linkstorms.com/

Online

Advertising/Navigation: We participated in the Series D

Preferred financing of Linkstorm, which offers ad enhancement

technology and a new way to navigate the web. Linkstorm allows

users to preview multiple relevant destinations within a single menu

by hovering over a link, image, ad or any other anchor to "unfurl"

the menu and make ads two to five times more effective.

www.linkstorms.com/

Electroluminescent

Advertising Media: West Olympic assisted with seed capital for a

new provider of flat, flexible, animated electronic signs that use

90% less energy than LED or Neon signs. Tesla Vision sells to large

businesses through major media channels and is now publicly traded

under TSLV. www.teslavision.com

Electroluminescent

Advertising Media: West Olympic assisted with seed capital for a

new provider of flat, flexible, animated electronic signs that use

90% less energy than LED or Neon signs. Tesla Vision sells to large

businesses through major media channels and is now publicly traded

under TSLV. www.teslavision.com

Online

Services Marketplace: We provided equity funding for

WhoCanHelp.com, an online local directory and marketplace for users

to identify local service providers. The tool is offered by

local chamber of commerce groups as a business benefit for lead

generation.

www.whocanhelp.com/

Online

Services Marketplace: We provided equity funding for

WhoCanHelp.com, an online local directory and marketplace for users

to identify local service providers. The tool is offered by

local chamber of commerce groups as a business benefit for lead

generation.

www.whocanhelp.com/

Smartphone

indoor mapping: West Olympic participated in the convertible

bridge financing of this software company that provides iPhone,

Android, and other smartphone applications for indoor maps such as

shopping centers and airports. These services also serve as an

advertising platform allowing businesses to reach mobile customers

in their vicinity.

www.pointinside.com

Smartphone

indoor mapping: West Olympic participated in the convertible

bridge financing of this software company that provides iPhone,

Android, and other smartphone applications for indoor maps such as

shopping centers and airports. These services also serve as an

advertising platform allowing businesses to reach mobile customers

in their vicinity.

www.pointinside.com

Transportation

Management Software: We contributed to the initial preferred

equity funding for this provider of shipping software and

transportation analytics. Enroute Systems Corporation provides

zero-install, end-to-end shipping solutions for businesses that

typically ship more than 1,000 packages per month.

www.enroutecorp.com

Transportation

Management Software: We contributed to the initial preferred

equity funding for this provider of shipping software and

transportation analytics. Enroute Systems Corporation provides

zero-install, end-to-end shipping solutions for businesses that

typically ship more than 1,000 packages per month.

www.enroutecorp.com

Biotechnology

Material Engineering: We provided angel funding for a new

provider of biomaterial solutions that enhance the biocompatibility

and performance of medically implanted devices. STAR® (Sphere

Templated Angiogenic Regeneration) biomaterial is a

precision-engineered three-dimensional biomaterial scaffold that is

designed to heal around a medical device and promote acceptance in

the body.

www.healionicscorp.com

Biotechnology

Material Engineering: We provided angel funding for a new

provider of biomaterial solutions that enhance the biocompatibility

and performance of medically implanted devices. STAR® (Sphere

Templated Angiogenic Regeneration) biomaterial is a

precision-engineered three-dimensional biomaterial scaffold that is

designed to heal around a medical device and promote acceptance in

the body.

www.healionicscorp.com

![]() Medical

Technology: Advanced Medical Isotope Corporation produces

medical isotopes used in molecular imaging, therapy, and nuclear

medicine to diagnose, manage and treat diseases. We provided

convertible note financing for this public company traded over the

counter under the symbol ADMD.

www.isotopeworld.com

Medical

Technology: Advanced Medical Isotope Corporation produces

medical isotopes used in molecular imaging, therapy, and nuclear

medicine to diagnose, manage and treat diseases. We provided

convertible note financing for this public company traded over the

counter under the symbol ADMD.

www.isotopeworld.com

Oral

Diagnostic Devices: West Olympic provided seed capital for this

supplier of non-invasive and rapid test medical products.

Oasis provides effective screening tools for early detection of

diseases and medical disorders, utilizing non-invasive test

specimens such as oral fluids (saliva) and whole blood. www.4saliva.com

Oral

Diagnostic Devices: West Olympic provided seed capital for this

supplier of non-invasive and rapid test medical products.

Oasis provides effective screening tools for early detection of

diseases and medical disorders, utilizing non-invasive test

specimens such as oral fluids (saliva) and whole blood. www.4saliva.com

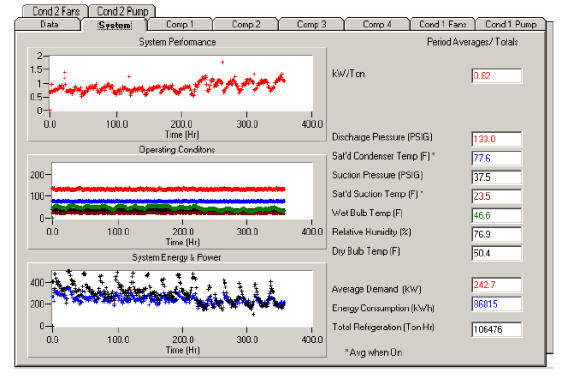

Engineering

Equipment and Consulting: We co-founded an engineering and

manufacturing company that provides high-efficiency refrigeration

technology to supermarkets and industrial manufacturing customers

throughout the West Coast of the U.S..

www.vacomtech.com

Engineering

Equipment and Consulting: We co-founded an engineering and

manufacturing company that provides high-efficiency refrigeration

technology to supermarkets and industrial manufacturing customers

throughout the West Coast of the U.S..

www.vacomtech.com

Computer/Network Equipment Exchange: We provided funding for an innovative secondary market for the resale of computer hardware and network equipment across the US.

Energy Management Outsourcing: We established a company to provide long term energy saving investments for industrial companies by partnering with a major Southern California electric utility. This business model funded energy-saving capital investments in return for long-term energy outsourcing agreements.

Consumer Products:

Manufacturer of Organic, Specialty Chocolates: Theo Chocolate is and organic, fair-trade chocolate manufacturing company from bean-to-bar. This award-winning company has international procurement and distribution throughout the U.S. for chocolate bars, confections, and specialty products. West Olympic provided bridge and equity funding for Theo Chocolate, and subsequently we provided asset-based financing and equity liquidity for founder stock. www.theochocolate.com

Specialty

Food Products, Flavorings, and Spices: We provided series

B preferred equity financing to J&D's Down Home enterprises, the

Seattle company best known for BaconSalt, Baconnaisse, Bacon

Croutons, and Bacon Popcorn products.

www.baconsalt.com

Specialty

Food Products, Flavorings, and Spices: We provided series

B preferred equity financing to J&D's Down Home enterprises, the

Seattle company best known for BaconSalt, Baconnaisse, Bacon

Croutons, and Bacon Popcorn products.

www.baconsalt.com

Low-Acid

Coffee Company: West Olympic participated in the preferred

equity funding for Puroast® Coffee. The patented Puroast

process brings together advanced energy technology with ancient

roasting methods. The result is a smooth, full-bodied gourmet

coffee that not only rivals the leading brands for taste, but has

50% to 80% less acid. Puroast® has distribution in many of the

nation’s leading retailers including Albertson’s and C&K Markets in

the Pacific Northwest. The Sustainable Business Institute in San

Jose, CA granted Puroast® their Seal of Sustainability.

www.puroast.com

Low-Acid

Coffee Company: West Olympic participated in the preferred

equity funding for Puroast® Coffee. The patented Puroast

process brings together advanced energy technology with ancient

roasting methods. The result is a smooth, full-bodied gourmet

coffee that not only rivals the leading brands for taste, but has

50% to 80% less acid. Puroast® has distribution in many of the

nation’s leading retailers including Albertson’s and C&K Markets in

the Pacific Northwest. The Sustainable Business Institute in San

Jose, CA granted Puroast® their Seal of Sustainability.

www.puroast.com

![]() Organic,

Ecologically Sustainable Materials: We are providing angel

funding for a global manufacturer of non-toxic, ethical, and

sustainable fabrics used in green buildings, furniture, and window

coverings.

www.oecotextiles.com

Organic,

Ecologically Sustainable Materials: We are providing angel

funding for a global manufacturer of non-toxic, ethical, and

sustainable fabrics used in green buildings, furniture, and window

coverings.

www.oecotextiles.com

Manufacturer

of Women's Accessories: West Olympic provided convertible

bridge loans and inventory financing for this manufacturing and

retailing organization that includes product design, overseas

production, and U.S. distribution of women's accessories. We

subsequently purchased this brand from the founders.

www.chelsey-henry.com

Manufacturer

of Women's Accessories: West Olympic provided convertible

bridge loans and inventory financing for this manufacturing and

retailing organization that includes product design, overseas

production, and U.S. distribution of women's accessories. We

subsequently purchased this brand from the founders.

www.chelsey-henry.com

Fashion Apparel Imports: West Olympic provided seed capital financing for Rocco e Dante, a women's handbag and accessory designer specializing in American designed Italian leather products, Italian hardware, and specialty women's accessories. www.roccoedante.com

Publisher

of Children's Magazines: We provided angel funding for

this Northwest publisher of children's magazines for families and

educators to encourage pre-school reading.

www.bluelakepublishing.com

Publisher

of Children's Magazines: We provided angel funding for

this Northwest publisher of children's magazines for families and

educators to encourage pre-school reading.

www.bluelakepublishing.com

Prograde

Ceramic Distributor:

West Olympic provided convertible

note financing to this Seattle-based designer and distributor of

serveware, bakeware, dinnerware and accessories for the home or

professional chef. This freezer/oven/microwave/dishwasher-safe

product also has a unique partnership with Goodwill Industries®.

www.sengware.com

Prograde

Ceramic Distributor:

West Olympic provided convertible

note financing to this Seattle-based designer and distributor of

serveware, bakeware, dinnerware and accessories for the home or

professional chef. This freezer/oven/microwave/dishwasher-safe

product also has a unique partnership with Goodwill Industries®.

www.sengware.com

Zino Fund Investments:

West Olympic has participated in each of the Zino Funds since inception. These funds are investments awarded to selected startup companies who participate in quarterly Zino investment forums. Examples of these Zino fund investments include the following:

Craft

distillery for botanical liqueurs: We joined in an LLC to

provide early financing for BroVo Spirits, makers of single note,

botanical liqueurs. broVo spirits is "lady-made liquor",

founded by two women and focused on cocktail experiences for

discriminating tastes.

www.brovospirits.com

Craft

distillery for botanical liqueurs: We joined in an LLC to

provide early financing for BroVo Spirits, makers of single note,

botanical liqueurs. broVo spirits is "lady-made liquor",

founded by two women and focused on cocktail experiences for

discriminating tastes.

www.brovospirits.com

Innovative

Medical Devices: A Zino fund contributed equity capital to

REDpoint International, Inc., a medical device company that has

developed primary tubing stabilization devices for catheters, the

StedLine Products System.

www.redpointcorp.com

Innovative

Medical Devices: A Zino fund contributed equity capital to

REDpoint International, Inc., a medical device company that has

developed primary tubing stabilization devices for catheters, the

StedLine Products System.

www.redpointcorp.com

Environmentally

Sound Plastics: We joined in an LLC to provide

second-round financing for MicroGREEN Polymers. Their Ad-air™

microcellular technology is used to reduce the material cost of

plastic products by 30% or more without compromising performance.

Recyclable MicroGreen Polymer products are ideal for food packaging

and plastics printing materials.

www.microgreeninc.com

Environmentally

Sound Plastics: We joined in an LLC to provide

second-round financing for MicroGREEN Polymers. Their Ad-air™

microcellular technology is used to reduce the material cost of

plastic products by 30% or more without compromising performance.

Recyclable MicroGreen Polymer products are ideal for food packaging

and plastics printing materials.

www.microgreeninc.com

Power and Telecommunication

Cable Technology: We joined with other investors in an LLC

to provide angel investment for a new company that extends the life

of aging in-ground cables for up to 40 more years.

www.novinium.com

Power and Telecommunication

Cable Technology: We joined with other investors in an LLC

to provide angel investment for a new company that extends the life

of aging in-ground cables for up to 40 more years.

www.novinium.com

Life

Sciences Manufacturing: We participated in an LLC to

provide early stage funding for the provider of ExoWalkTM,

which uses patented ExoTendonsTM to assist muscles and

improve mobility for individuals with disabilities.

http://www.cadencebiomedical.com/

Life

Sciences Manufacturing: We participated in an LLC to

provide early stage funding for the provider of ExoWalkTM,

which uses patented ExoTendonsTM to assist muscles and

improve mobility for individuals with disabilities.

http://www.cadencebiomedical.com/

![]() Renewable

Hydropower Technology: We participated in an LLC that provided

angel capital to this inventor of portable hydropower solutions.

Hydrovolts devices generate renewable energy from fast-flowing

currents. These turbines allow distributed and point-of-use

generation or can generate revenue from net metering to the

electrical grid.

www.hydrovolts.com

Renewable

Hydropower Technology: We participated in an LLC that provided

angel capital to this inventor of portable hydropower solutions.

Hydrovolts devices generate renewable energy from fast-flowing

currents. These turbines allow distributed and point-of-use

generation or can generate revenue from net metering to the

electrical grid.

www.hydrovolts.com

Outdoor

Lighting Controls: We participated with an LLC to provide early

round financing for Virticus. These products and services help

reduce energy and maintenance costs by 30-50% by utilizing a

communication and control system that enables the management of

lights individually and collectively.

www.virticus.com

Outdoor

Lighting Controls: We participated with an LLC to provide early

round financing for Virticus. These products and services help

reduce energy and maintenance costs by 30-50% by utilizing a

communication and control system that enables the management of

lights individually and collectively.

www.virticus.com

![]() Food

Preservation Technology: We teamed within an LLC to provide

seed capital to NanoICE, a manufacturer of nanotechnology specialty

ice making machines. NanoICE, Inc.'s proprietary technology is

the only preservation solution in the world with UptakeENERGY™ -

revolutionary new science that gives fresh raw material a fighting

chance against bacteria, oxidation and decay.

http://www.nanoiceusa.com/

Food

Preservation Technology: We teamed within an LLC to provide

seed capital to NanoICE, a manufacturer of nanotechnology specialty

ice making machines. NanoICE, Inc.'s proprietary technology is

the only preservation solution in the world with UptakeENERGY™ -

revolutionary new science that gives fresh raw material a fighting

chance against bacteria, oxidation and decay.

http://www.nanoiceusa.com/

Sporting

Equipment Manufacturer: Our fund teamed within an LLC to

provide seed capital to Bangee Bungee, a manufacturer of sporting

bungee cords tailored to snow and water sports.

www.bansheebungee.com

Sporting

Equipment Manufacturer: Our fund teamed within an LLC to

provide seed capital to Bangee Bungee, a manufacturer of sporting

bungee cords tailored to snow and water sports.

www.bansheebungee.com

Health Food Antioxidant Juice Company: We joined with other investors in an LLC to provide angel investment for this juice company that produces healthy cherry, blueberry, and raspberry juice products with proven antioxidant health benefits. www.CHERRish.net

Guitar

tuning electronics company: We joined in an LLC to provide

equity funding for Zero Crossing, Inc., the manufacturer of N-Tune:

a patented guitar tuning device sold as an after market product as

well as directly built-in to the guitar by several major

manufacturers. The artist simply pulls the guitar's volume

knob and uses N-Tune's super-bright display to silently tune up in

seconds. Then a simple push again to play -- with no affect on the

instrument's tone, thanks to N-Tune's true bypass design which

removes all tuning circuitry from the signal path.

http://www.ntune.com

Guitar

tuning electronics company: We joined in an LLC to provide

equity funding for Zero Crossing, Inc., the manufacturer of N-Tune:

a patented guitar tuning device sold as an after market product as

well as directly built-in to the guitar by several major

manufacturers. The artist simply pulls the guitar's volume

knob and uses N-Tune's super-bright display to silently tune up in

seconds. Then a simple push again to play -- with no affect on the

instrument's tone, thanks to N-Tune's true bypass design which

removes all tuning circuitry from the signal path.

http://www.ntune.com

Environmental

Friendly Footwear: We joined in an LLC to provide angel

investment for END footwear, an outdoor footwear and gear

manufacturer specializing in sustainable and environmentally

friendly products. In 2009 END was acquired by LaCrosse

Footwear, Inc. (Nasdaq/NMS: BOOT)

Environmental

Friendly Footwear: We joined in an LLC to provide angel

investment for END footwear, an outdoor footwear and gear

manufacturer specializing in sustainable and environmentally

friendly products. In 2009 END was acquired by LaCrosse

Footwear, Inc. (Nasdaq/NMS: BOOT)